knoxville tn state sales tax rate

The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. This amount is never to exceed 3600.

![]()

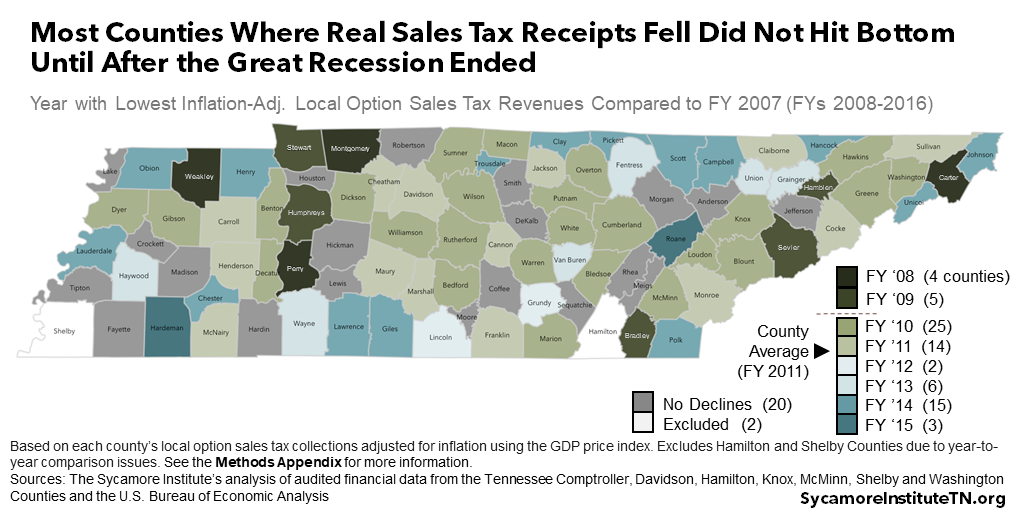

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

. Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County Tennessee State. Wayfair Inc affect Tennessee. For purchases in excess of 1600 an additional state tax of 275 is added up to a maximum of 44.

Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. 212 per 100 assessed value. The 2018 United States Supreme Court decision in South Dakota v.

The base state sales tax rate in Tennessee is 7. Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None. The sales tax holiday in Tennessee has historically meant that any purchase of computers clothing and school supplies were not taxed.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Johnson City 423. The Tennessee state sales tax rate is currently.

The general state tax rate is 7. The latest sales tax rates for cities in Tennessee TN state. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. Did South Dakota v.

The Tennessee sales tax rate is currently. Within Knoxville there are around 31 zip codes with the most populous zip code being 37918. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975 Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

In 2021 Tennessee honored a sales tax holiday three different times throughout the year with more planned for 2022. Other local-level tax rates in Tennessee are relatively complex when compared to other states local-level tax rates. Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None.

Local collection fee is 1 Fees Title Fee 1100 Licenses plate fee. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Food is taxed at 4 instead of the state rate of 7.

Current Sales Tax Rate. City of Knoxville Revenue Office 865-215-2084. 925 7 state 225 local City Property Tax Rate.

The Knox County sales tax rate is. Local Sales Tax is 225 of the first 1600. Sales Tax Knoxville 225.

Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None. The total sales tax rate might be as high as 10 depending on local tax authorities. 24638 per 100 assessed value.

31 rows Germantown TN Sales Tax Rate. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales. As reported by CarsDirect Tennessee state sales tax is 7 percent of a vehicles total purchase price.

The County sales tax rate is. This is the total of state and county sales tax rates. Knox County TN Sales Tax Rate.

The general state tax rate is 7. 1 State Sales tax is 700. 9750 without affidavit of counseling.

Real property tax on median home. Sales Tax and Use Tax Rate of Zip Code 37995 is located in Knoxville City Knox County Tennessee State. This is the total of state county and city sales tax rates.

Find your Tennessee combined state and local tax rate. For example if you buy a car. County Property Tax Rate.

Rates include state. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. What Are Tennessees State City and County Sales Tax Rates.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. The local tax rate varies by county andor city. 1 State Sales tax is 700.

Sales Tax State 700. City of Knoxville Revenue Office. 8 rows The local sales tax rate in Knox County is 275 and the maximum rate including Tennessee.

The Knoxville sales tax rate is. The state sales tax rate in Tennessee TN is 70 percent. The local tax rate varies by county andor city.

The sales tax is comprised of two parts a state portion and a local portion. Sales Tax State Local Sales Tax on Food. 3750 with affidavit of counseling.

The minimum combined 2022 sales tax rate for Knox County Tennessee is.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Is Food Taxable In Tennessee Taxjar

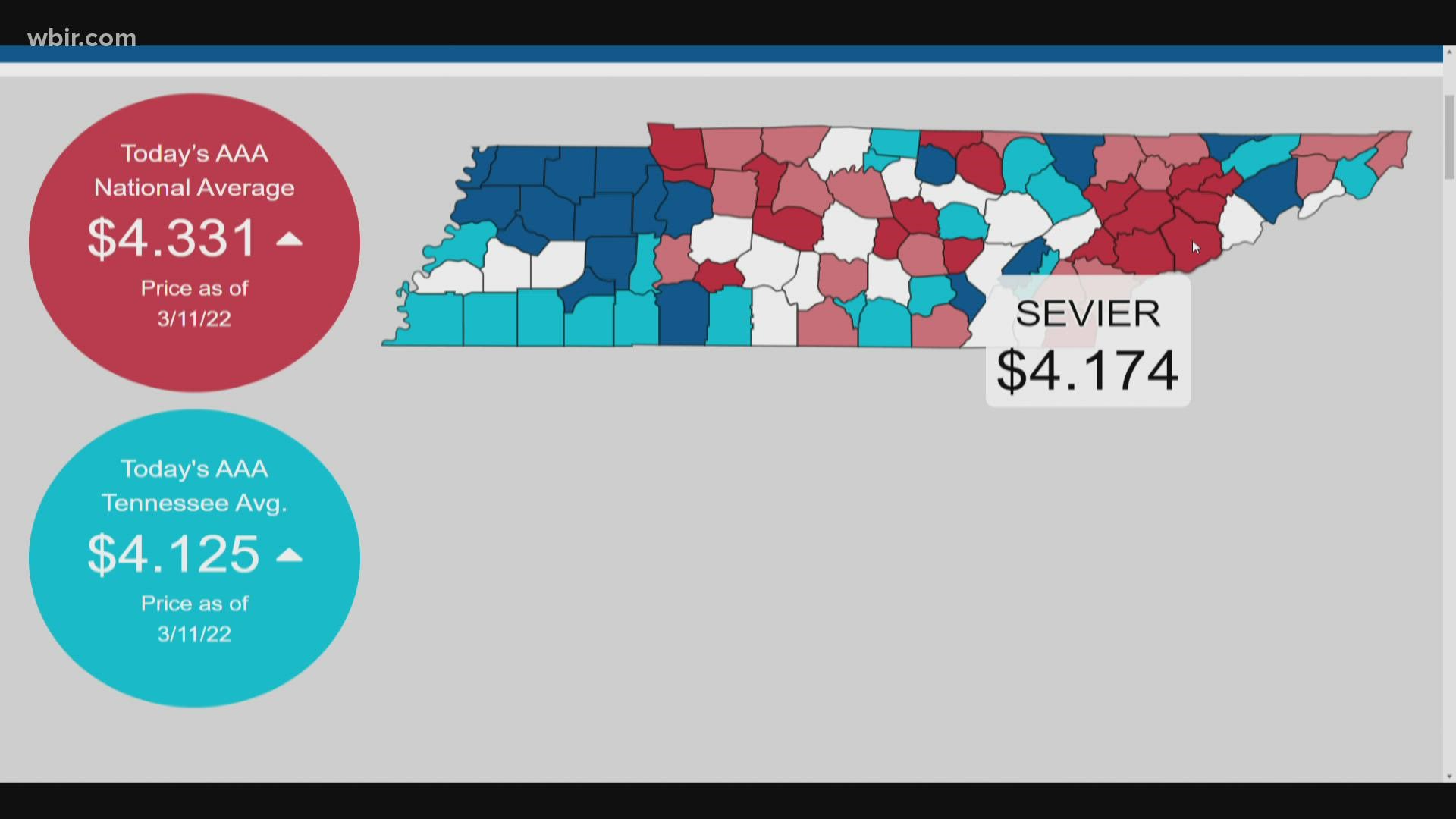

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Vape E Cig Tax By State For 2022 Current Rates In Your State

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

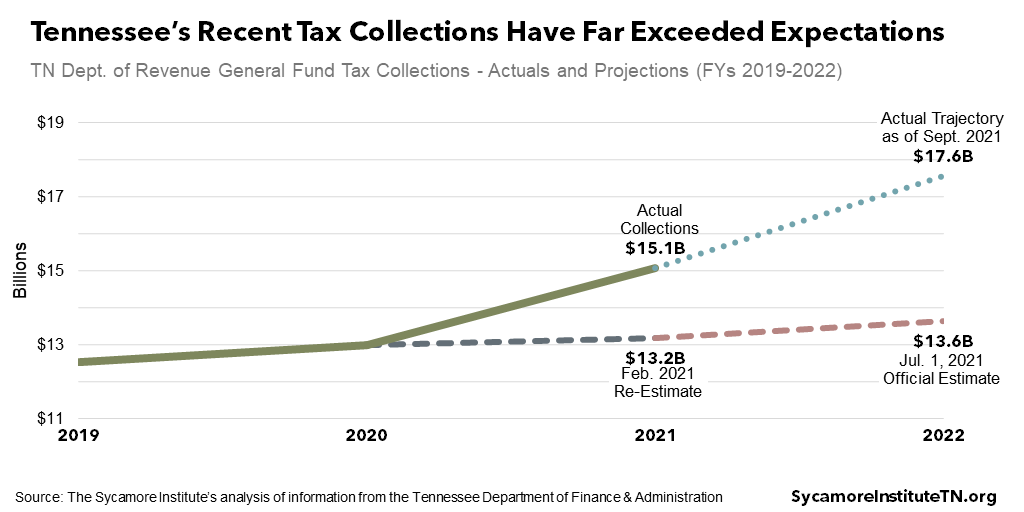

Tennessee May Have An Extra 3 Billion To Budget Next Year

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Pin By Lauren Ashley On Across The Universe Straight Outta M Town Memphis Map Tennessee Map Memphis

Vape E Cig Tax By State For 2022 Current Rates In Your State

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Taxes Do Residents Pay Income Tax H R Block

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation